- Refocusing on Specialty Protection Products and Services with Greatest Profitable Growth Potential

- Exploring Strategic Alternatives for Health and Employee Benefits Businesses to Maximize Shareholder Value

- Preparing to Exit Health Insurance Market in 2016

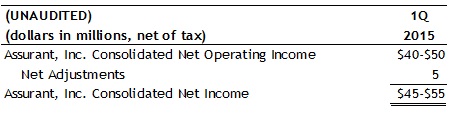

- Expecting to Report 2015 First Quarter Consolidated Net Operating Income of $40 Million to $50 Million; Health Business Segment 2015 First Quarter Net Operating Loss of $80 Million to $90 Million

NEW YORK, April 28, 2015 – Assurant, Inc. (NYSE: AIZ) announced that, following a strategic review of its business portfolio, the Company will focus its resources on niche housing and lifestyle protection offerings where it holds market leading positions to consistently generate specialty returns long term. In reshaping the Company’s portfolio, Assurant is exploring strategic alternatives for its employee benefits and health business segments, including the sale of each business. Absent a sale of the health business segment, the Company plans to substantially complete its exit from the health insurance market in 2016.

Realigning Business Strategy

Assurant’s sharper focus will enable the Company to build upon its core capabilities to further capitalize on global consumer and market trends in the housing and lifestyle protection markets. The Company will broaden the integrated protection products and services from its Assurant Specialty Property and Assurant Solutions business segments to help customers protect against risk, including offerings such as mobile and other extended service contracts, lender-placed insurance, multi-family housing, mortgage solutions, vehicle service contracts and pre-funded funeral plans.

“We have established significant momentum in our specialty housing and lifestyle protection businesses where we have developed strong competitive positions in the U.S. and select international markets. Recognizing the wide array of additional growth opportunities in these areas, we will concentrate resources where we can generate sustainable specialty returns as we pursue our aspirations of outperformance,” said Assurant President and CEO Alan B. Colberg. “The health and employee benefits business segments possess differentiated capabilities in their respective markets, but we do not believe they can meet our return targets at the pace we require. While this is a difficult decision, we believe they would be strong assets for new owners that are focused more exclusively on health care and employee benefits. During this process, Assurant remains dedicated to upholding our commitments to customers and policyholders.”

Assurant Employee Benefits serves more than 30,000 small and mid-sized employers, providing a robust product suite of voluntary and employer-paid products including dental, long-term and short-term disability and life insurance. With nearly one million customers, Assurant Health provides a broad array of insurance coverage to individuals, families and small employers including major medical, short-term and supplemental plans.

Proceeds from any transaction will provide Assurant additional financial flexibility to invest in areas targeted for growth and return capital to shareholders. Barclays Capital is serving as financial advisor to Assurant to assist in the exploration of strategic alternatives for its health and employee benefits businesses.

Preliminary First Quarter Results

Assurant also announced today preliminary 2015 first quarter consolidated net operating income1 in the range of $40 million to $50 million. The Company expects its operating segments, Assurant Solutions, Assurant Specialty Property and Assurant Employee Benefits, to report results in line with its expectations and outlook provided in its Feb. 12, 2015 earnings release.

The Company expects Assurant Health to report a net operating loss for the quarter in the range of $80 million to $90 million. Approximately half of the loss is attributable to a reduction in 2014 estimated recoveries from the Affordable Care Act (ACA) risk mitigation programs. The remainder reflects elevated claims on 2015 ACA policies. Absent a sale of Assurant Health, the Company will begin the process this year to exit the health insurance market and will not participate in the next ACA open enrollment period beginning in November. The Company's exit will be substantially complete in 2016.

As of March 31, 2015, corporate capital stood at approximately $570 million. Excluding the Company’s $250 million risk buffer, deployable capital was approximately $320 million, including proceeds from the sale of American Reliable Insurance Company. During the first quarter, the Company repurchased $81.7 million of common stock. Dividends to shareholders totaled $18.8 million for the period.

Assurant will release 2015 first quarter results on Tuesday, May 5, 2015 after the market closes. In conjunction with the earnings release, Assurant will host a conference call the next morning, Wednesday, May 6, 2015 at 8 a.m. ET. The call will be available to the public via live audio webcast.

About Assurant

Assurant safeguards clients and consumers when the unexpected occurs. A provider of specialty protection products and related services, Assurant operates in North America, Latin America, Europe and other select worldwide markets through four operating segments. Assurant Solutions, Assurant Specialty Property, Assurant Health and Assurant Employee Benefits partner with clients who are leaders in their industries to provide consumers peace of mind and financial security. Our diverse range of products and services include mobile device protection products and services; debt protection administration; credit-related insurance; warranties and extended service programs and related services for consumer electronics, appliances and vehicles; pre-funded funeral insurance; lender-placed homeowners insurance; property, appraisal, preservation and valuation services; flood insurance; renters insurance and related products; manufactured housing homeowners insurance; individual health and small employer group health insurance; group dental insurance; group disability insurance; and group life insurance.

Assurant, a Fortune 500 company and a member of the S&P 500, is traded on the New York Stock Exchange under the symbol AIZ. Assurant has approximately $32 billion in assets and $10 billion in annual revenue. Assurant has approximately 17,500 employees worldwide and is headquartered in New York's financial district. For more information on Assurant, please visit www.assurant.com and follow us on Twitter @AssurantNews.

Media Contact:

Vera Carley

Assistant Vice President, External Communication

Phone: 212.859.7002

[email protected]

Investor Relations Contact:

Suzanne Shepherd

Assistant Vice President, Investor Relations

Phone: 212.859.7062

[email protected]

Forward-Looking Statements

Some of the statements included in this press release, particularly those anticipating future financial performance, business prospects, growth and operating strategies and similar matters, constitute forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those projected in the forward-looking statements. The Company undertakes no obligation to update any forward-looking statements in this press release as a result of new information or future events or developments. For a detailed discussion of risk factors that could affect our results, please refer to the risk factors identified in our annual and periodic reports, including but not limited to our 2014 Annual Report on Form 10-K as filed with the U.S. Securities and Exchange Commission.

Non-GAAP Financial Measures

1) Assurant uses net operating income as an important measure of the Company’s operating performance. Net operating income equals net income, excluding net realized gains (losses) on investments and other unusual and/or infrequent items. The Company believes net operating income provides investors a valuable measure of the performance of the Company’s ongoing business, because it excludes both the effect of net realized gains (losses) on investments that tend to be highly variable from period to period, and those events that are unusual and/or unlikely to recur. Because Assurant’s calculation of these measures may differ from similar measures used by other companies, investors should be careful when comparing Assurant’s non-GAAP financial measures to those of other companies.

Reconciliation of Assurant, Inc. Consolidated Net Operating Income to Consolidated Net Income